best tax saving strategies for high income earners

Adjusted Gross Income Average Total. Quoting the landlords Permanent Account Number PAN is mandatory if the rent paid is more than Rs 1 lakh annually ie Rs 8333 a month to avail the full benefit of HRA.

Self Employment Tax Rate Higher Income Investing Dividend Income

House Rent Allowance HRA is a part of most employees salary structures.

. Tax Saving Strategies for High-Income Earners. If you are over the age of 59 12 and. Then again nobody.

For most high-income earners saving for your retirement through super is a sensible strategy but you need to watch you dont end up paying extra tax on your concessional before-tax super contributions. That means high earners may be better off contributing to the traditional 401k and taking the tax deduction now at their high marginal tax rate than saving in a Roth account. Convert your SIMPLE SEP or traditional IRA to a Roth IRA.

Change the Character of Your Income. To avail the HRA exemption you need to submit rent receipts or the rent agreement with the house owner to your employer. One way to reduce your tax burden is to change the character of your income.

Under the Division 293 tax rules if your income and concessional contributions total more than 250000 in 202122 you may have to pay an additional 15 tax on some or. To get a better idea of the difference in tax payments between low- moderate- and high-income earners take a look at the 2018 tax payments by income level. If youre wondering why you should do so here are some of the ways it can help you to lower your tax bill.

Tax Strategies For High Income Earners Pillar Wealth Management

5 Outstanding Tax Strategies For High Income Earners

The 4 Tax Strategies For High Income Earners You Should Bookmark

10 Easy Ways To Save Income Tax In India Income Tax Ways To Save Tax

Tax Minimisation Strategies For High Income Earners

How To Create A Social Media Aesthetic Top 5 Useful Tips In 2021 Helpful Hints Social Media Social Networking Sites

A Back Door Roth Ira Strategy Benefits High Earners Strategies Ira Roth Ira

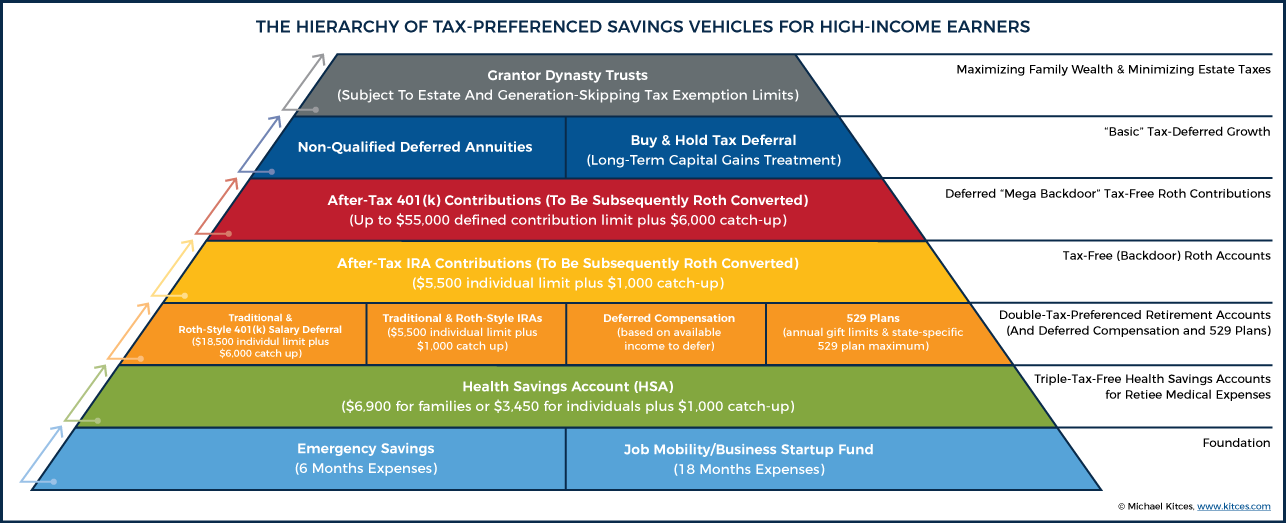

The Hierarchy Of Tax Preferenced Savings Vehicles

High Income Earners Fail To Appreciate The Math Of 529 Plans Part Ii Resource Planning Group 529 Plan Saving For College Retirement Savings Plan