richmond property tax rate

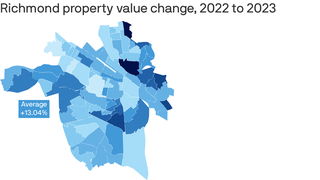

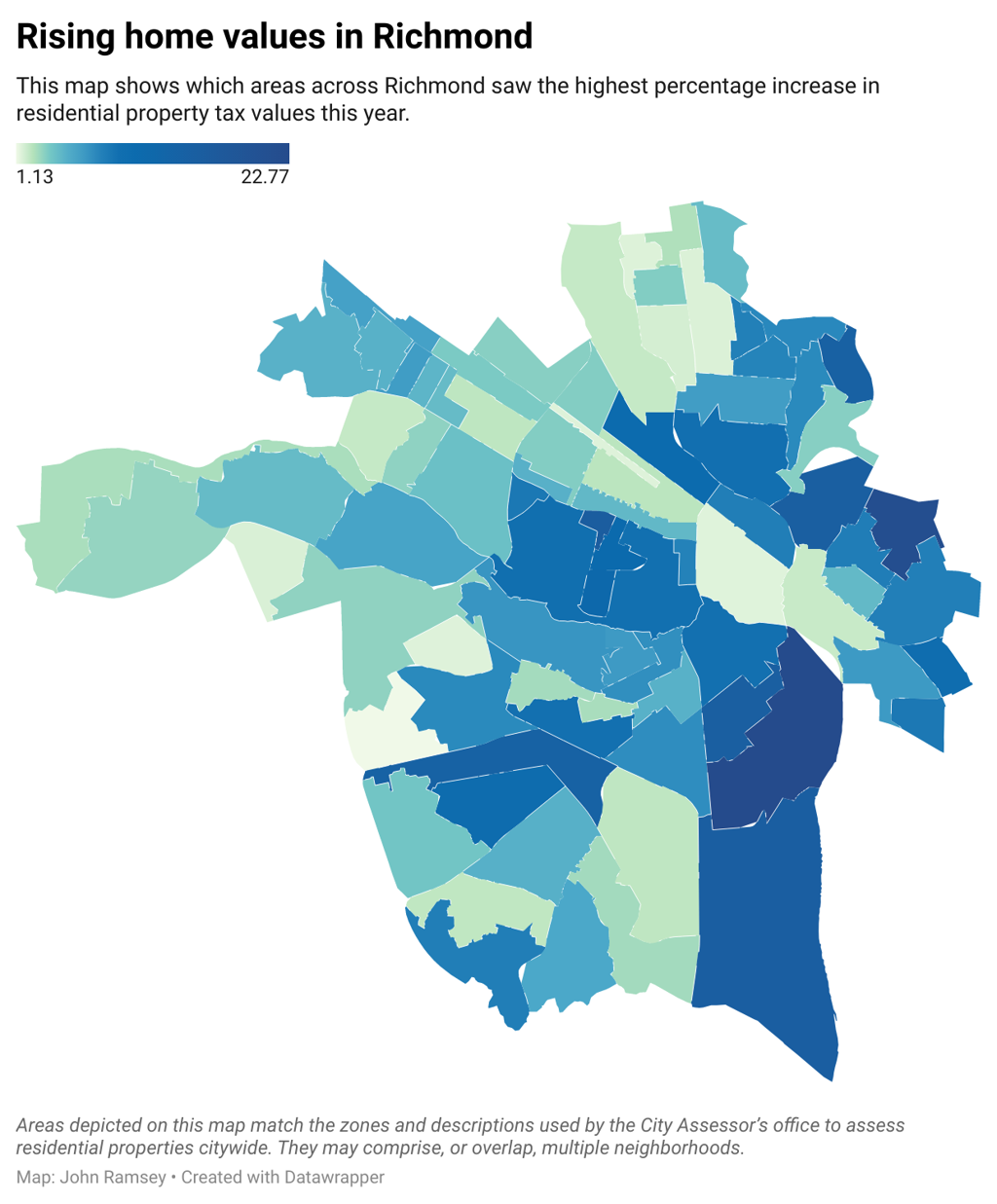

Richmond City Council is considering lowering the real property tax rate as property values across the city increased 13 on average from a year prior. Property Taxes Due 2021 property tax bills were due as of November 15 2021.

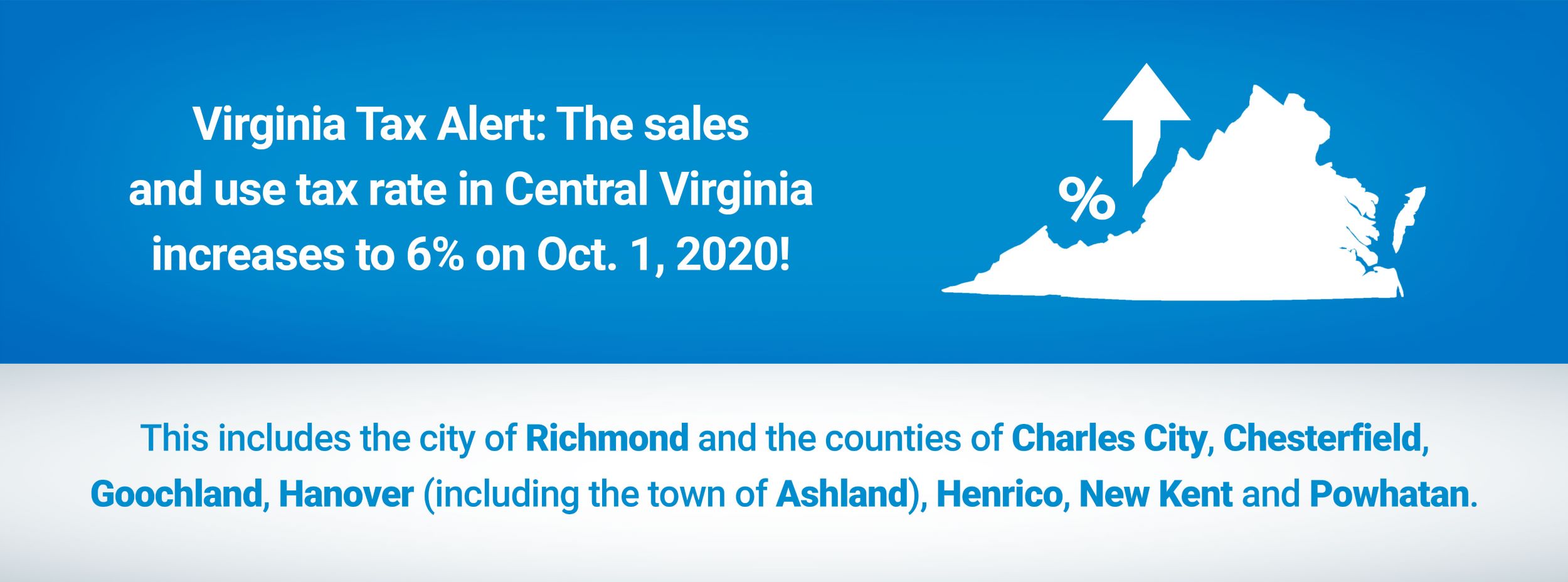

Sales Tax Increase In Central Virginia Region Beginning Oct 1 2020 Virginia Tax

Richmond County collects on average 103 of a propertys.

. Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. 295 with a minimum of 100. Under the state Code reexaminations must occur at least once within a three-year timeframe.

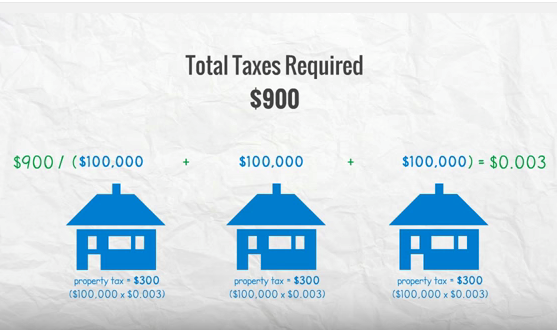

We have done our best to provide links to information regarding the County and the many services it provides to. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate. Personal property tax bills have been mailed are available online and currently are due June 5 2022.

These documents are provided in Adobe Acrobat PDF format for printing. The median property tax in Richmond County North Carolina is 732 per year for a home worth the median value of 71300. For all who owned property on January 1 even if the property has been sold a tax bill will still.

These agencies provide their required tax rates and the City collects the taxes on their behalf. Building Department. Along with collections property taxation involves two additional general steps.

Formulating real estate tax rates and conducting appraisals. The median property tax in Richmond County New York is 2842 per year for a home worth the median value of 461700. Taxing units include Richmond county.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as. Richmond County collects on average 062 of a propertys. RICHMOND CITY HALL 450 Civic Center Plaza Richmond CA 94804.

Other Services Adopt a pet. A 10 yearly tax hike is the maximum raise allowed on the capped properties. The City Assessor determines the FMV of over 70000 real property parcels each year.

PAY YOUR PERSONAL PROPERTY TAXES ONLINE OR BY MAIL. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate. Electronic Check ACHEFT 095.

The City Assessor determines the FMV of over 70000 real property parcels each year. The median property tax in Richmond County Virginia is 673 per year for a home worth the median value of 148700. Property tax payments may be paid by cheque bank draft.

The City of Richmond is not accepting property tax payments in cash until March 31 2021 due to pandemic safety measures. Welcome to the official Richmond County VA Local Government Website. Property Tax Vehicle Real Estate Tax.

For information and inquiries regarding amounts levied by other taxing authorities please contact. Real Estate and Personal Property Taxes Online Payment. Richmond County collects on average 045 of a propertys.

Where Richmond Property Values Went Up Most Axios Richmond

Richmond To Maintain Real Estate Tax Rate After Considering 6 5 Cent Rollback To Offset Rising Property Values Richmond Latest News Richmond Com

Virginia Property Tax Calculator Smartasset

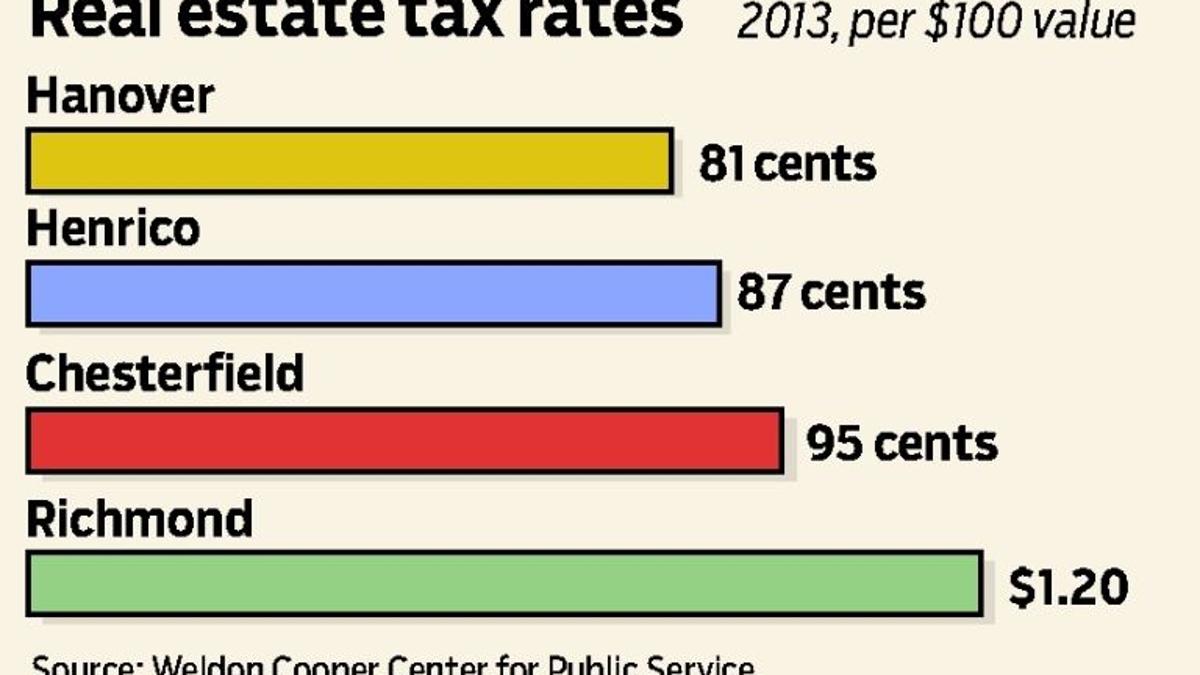

Chesterfield Weighs Raising Its Property Tax Richmond Com

Newton City Council Sets 2022 Property Tax Rates Newton Ma Patch

Where Richmond Property Values Went Up Most Axios Richmond

Where Your Property Tax Dollars Go Contra Costa County Ca Official Website

Richmond Property Tax How Does It Compare To Other Major Cities

With New Cuyahoga County Appraisals Most Property Tax Bills Will Rise See Partial Estimates For Your City Cleveland Com

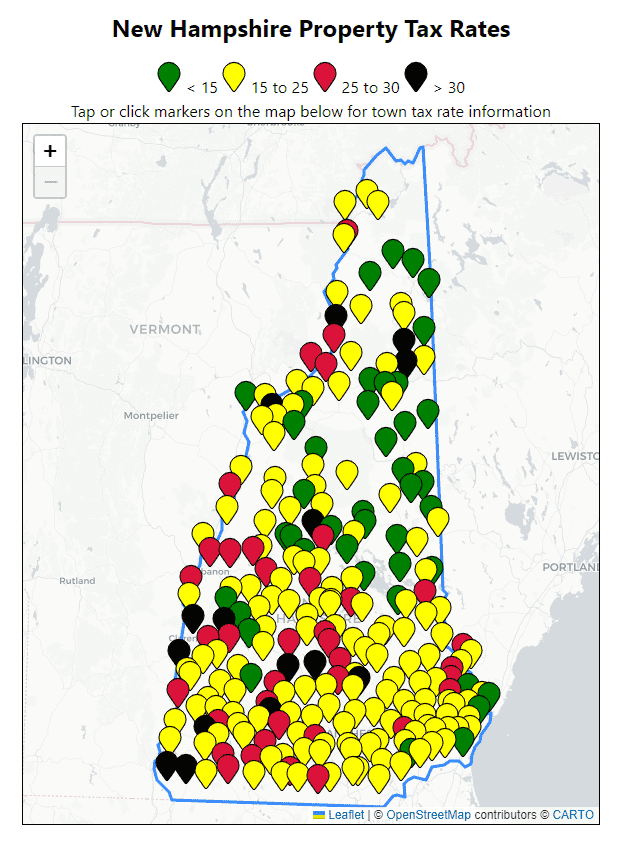

All Current New Hampshire Property Tax Rates And Estimated Home Values

Jump In Richmond Property Values Renews Push To Cut Real Estate Tax Rate Wric Abc 8news

Can You Explain The Proposed Property Tax Increase For Knoxville Tennessee Mansion Global

Letter Taxes Out Of Control In Richmond Richmond News

2014 Property Taxes In Metro Vancouver Fraseropolis

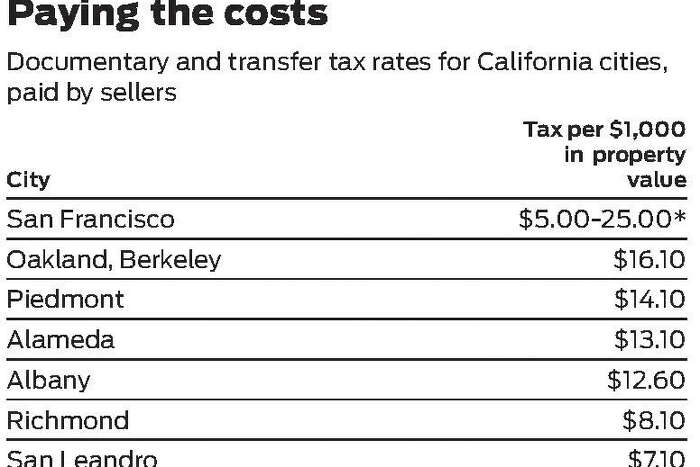

Sf Proposes Transfer Tax Increase On Properties Over 5 Million

Richmond Economic Development Corporation Richmond Tx Official Website