mortgage refinance transfer taxes

Comparing lenders has never been easier. Refinancing to a lower mortgage rate means youll be paying less interest which means youll have less mortgage interest to deduct when tax time comes around.

Refinancing Your House How A Cema Mortgage Can Help

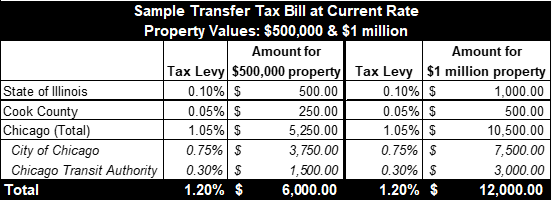

Real estate transfer taxes are considered part of the closing costs in a home sale and are due at the closing.

. Apply Get a Quote Now. Get Started Today as Rates are Increasing. 5 percent of the actual consideration unless they are a first-time Maryland home buyer purchasing a principal place of residence in that case the transfer tax rate is.

In this instance the original mortgage recording tax is transferred along with the mortgage account and all of its interest to the new lending company. You usually will pay a mortgage transfer tax any time you take out a loan on your home â for example when refinancing our taking out a home equity loan â not only when taking out a mortgage to. It is referred to as the mansion tax and it is typically one percent of the sale price.

May 23 2013. 2022s Lowest Home Loan Refinance Rates From Top Lenders. Does not apply to refis just purchased in PA.

A cash-out refinance allows you to borrow from your home equity which is the difference between your current mortgage balance and the total value of your home. For example if you earn 50000 a year before taxes and you have 5000 worth of deductions youd only pay taxes on 45000 of your income. Call us for a quote 2675144630 x1.

25 percent of the actual consideration. Therefore no new deed transfer taxes are paid. Note that transfer tax rates are often described in terms of the amount of tax charged per 500.

For example a homeowner who paid 2000 in points on a 30-year mortgage 360 monthly payments could deduct 556 per payment or a total of 6672 for 12 payments. Rather than the Seller paying transfer tax on the full sale price the transfer tax is the sale price less the amount of the mortgage obtained by Buyer. 50000 x 205 1025 Recorded Mortgage on Full Refinanced Amount.

A transfer tax also known as a deed transfer tax is imposed by states counties andor municipalities when real estate is transferred from one owner to another. In various jurisdictions transfer taxes are also called real estate conveyance taxes mortgage. Cute way to tax people.

Transfer Tax 19 14 County 5 State - Recordation Tax also charged on refinances and 2nd trusts if property is not owner occupied. Ad LendingTree Makes Your Mortgage Refinance Search Quick and Easy. Additional fees Associated with a CEMA.

One analogy refers to this as the real estate sales tax. To qualify for this discount you need to provide a statement under oath that states you are. It might also be added that apparently there is a transfer tax if you refinance and go from a title in a persons name to a title in that persons TRUST.

Todays average rate on a 30-year fixed-mortgage refinance is 564 compared to the 554 average rate a week earlier. That means a home that sells for 1 million is has a transfer tax of 14. The difference can be substantial.

Your transfer tax is equal to a percentage of the sale price or appraised value of the real estate that you buy or sell. Ad 2021s Mortgage Refinance Reviews. Unlike real estate transfer taxes mortgage transfer taxes are calculated as a percentage of the mortgage instead of a percentage of the homeâs sale price.

Some states such as North Dakota and New Mexico have no transfer tax at all. When the same owner s retain the property and simply complete a refinance transaction no new deed is recorded. Ad Our Team Of Mortgage Experts Will Work To Find The Refinance Solution Thats Right For You.

Nerdwallet Reviewed Refinance Lenders To Help You Find The Right One For You. The New York City Mortgage Recording Tax MRT rate is 18 for loans lower than 500000 and 1925 for loans of 500000 or more. First-Time Homebuyer Transfer Tax Discount.

Transfer Taxes Transfer tax is at the rate of. Some counties in the US levy what is known as an optional transfer tax. Taxpayers may deduct points only for those payments actually made in the tax year according to Jones.

For those of you seeking ways to save money on refinancing consider a mortgage assignment. The New York State transfer tax rate is currently 04 of the sales price of a home. One point equals 1 of the loan amount so if you paid 2 points on a 100000 loan for example you would have paid 2000.

You reduce the overall amount of money that you need to pay taxes on when you take a deduction. In a refinance transaction where property is not transferred between two parties no deed transfer taxes are due. If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes.

Indeed a first-time Maryland homebuyer. It will then revise and reissue the mortgage to the borrower. Some states will add an additional transfer tax if you sell a property for 1000000 or more.

500 2 is 1000 and that would be what you owe in transfer taxes for the sale. Refinance tax deductions are select deductions you can take after you refinance your mortgage loan. Current 30-Year Fixed-Mortgage Refinance Rates.

If you paid points when you refinanced your mortgage you may be able to deduct them. For example in Michigan state transfer taxes are levied at a rate of 375 for every 500 which translates to an effective tax rate of 075 375 500 075. Comparisons Trusted by 45000000.

If you are purchasing your primary residence in Maryland for the first time half of the state transfer tax amount is exempt making the tax rate 025 of actual consideration instead of 05. There is a flip side to arranging for the savings on mortgage recording tax. New York homeowners looking to refinance an existing mortgage dont have to pay the states mortgage recording tax all over again.

Many states charge a feetax when a home is sold sometimes that is paid by the seller sometimes by the buyer. Points are prepaid interest. 2 days ago30-year mortgage refinance rate.

For example if your home is worth. Find Out How Much You Can Save With Citizens. New York 2000.

Today the average 15-year fixed refinance rate is 483. For example Colorado has a transfer tax rate of 001 while people in Pittsburgh have to deal with a 4 rate. If you sold the property for 250000 you would divide 250000 by 500 which is 500.

North Carolina 1000. Your lender does not know what they are doing. The 52-week high for a 30.

Other states charge a fee everytime there is a new mortgage recorded. Some states also levy the tax when a. In New York State this process is.

Transfer tax differs across the US. Yet they may end up doing so if their lenders. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

10-year mortgage refinance rate. You pay them upfront to get a lower interest rate during the period when youre repaying the loan. If youve been paying 5 percent on a 30-year mortgage loan and refinance to a 15-year fixed-rate mortgage at 3 percent youve suddenly reduced your interest costs by 40 percent.

If your 2021 refinance was a second or more refinance the undeducted. 2400 12 680 034 None. Compare top lenders in 1 place with LendingTree.

In some states the transfer tax is known by other names including deed tax mortgage registry tax or stamp tax. Ad Compare the Current Competitive Home Loan Refinance Rates Lower Your Monthly Payments. New York State Transfer Tax and Mansion Tax is 10 penalty plus 2 per month or part thereof up to 25.

- Recordation Tax also charged if owner occupied but 12 months has not elapsed since property was purchased. Ad Compare Top Mortgage Refinance Lenders. Refinance transfer taxes refinance mortgage transfer tax florida florida transfer taxes for refinance florida mortgage refinance tax florida state mortgage tax florida transfer taxes mortgage florida mortgage refinance cost florida mortgage transfer tax calculator Barber amp Fitzgerald today to prefer look for clients before signing.

Delaware First Time Home Buyer State Transfer Tax Exemption Prmi Delaware

Understanding Mortgage Closing Costs Lendingtree

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Understanding Mortgage Closing Costs Lendingtree

What Are Real Estate Transfer Taxes Forbes Advisor

Understanding Mortgage Closing Costs Lendingtree

What Goes Into Closing Costs Mortgage Loan Credit Refinance Loans Financing Banking Reales Real Estate Infographic Real Estate Tips Real Estate

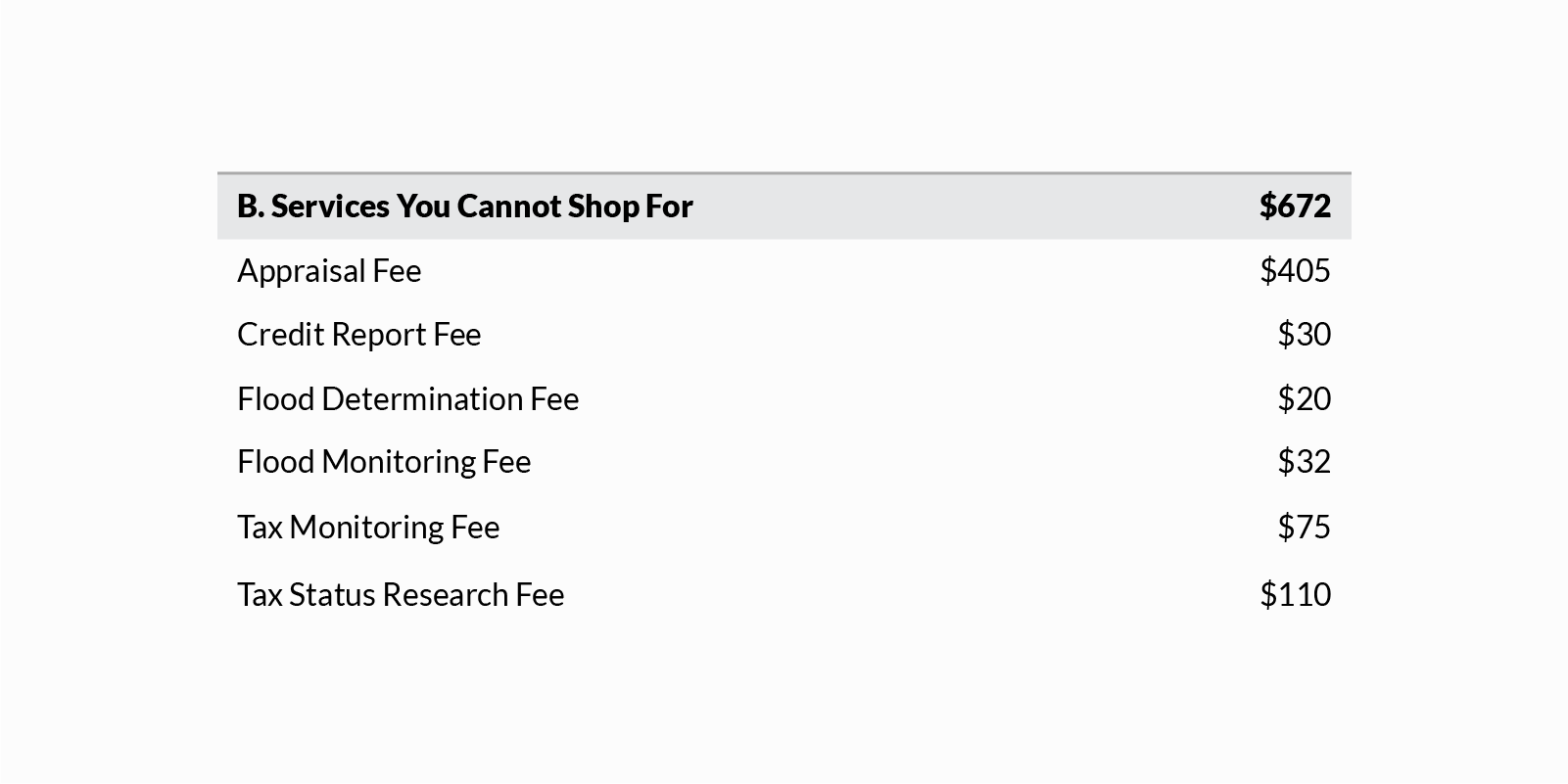

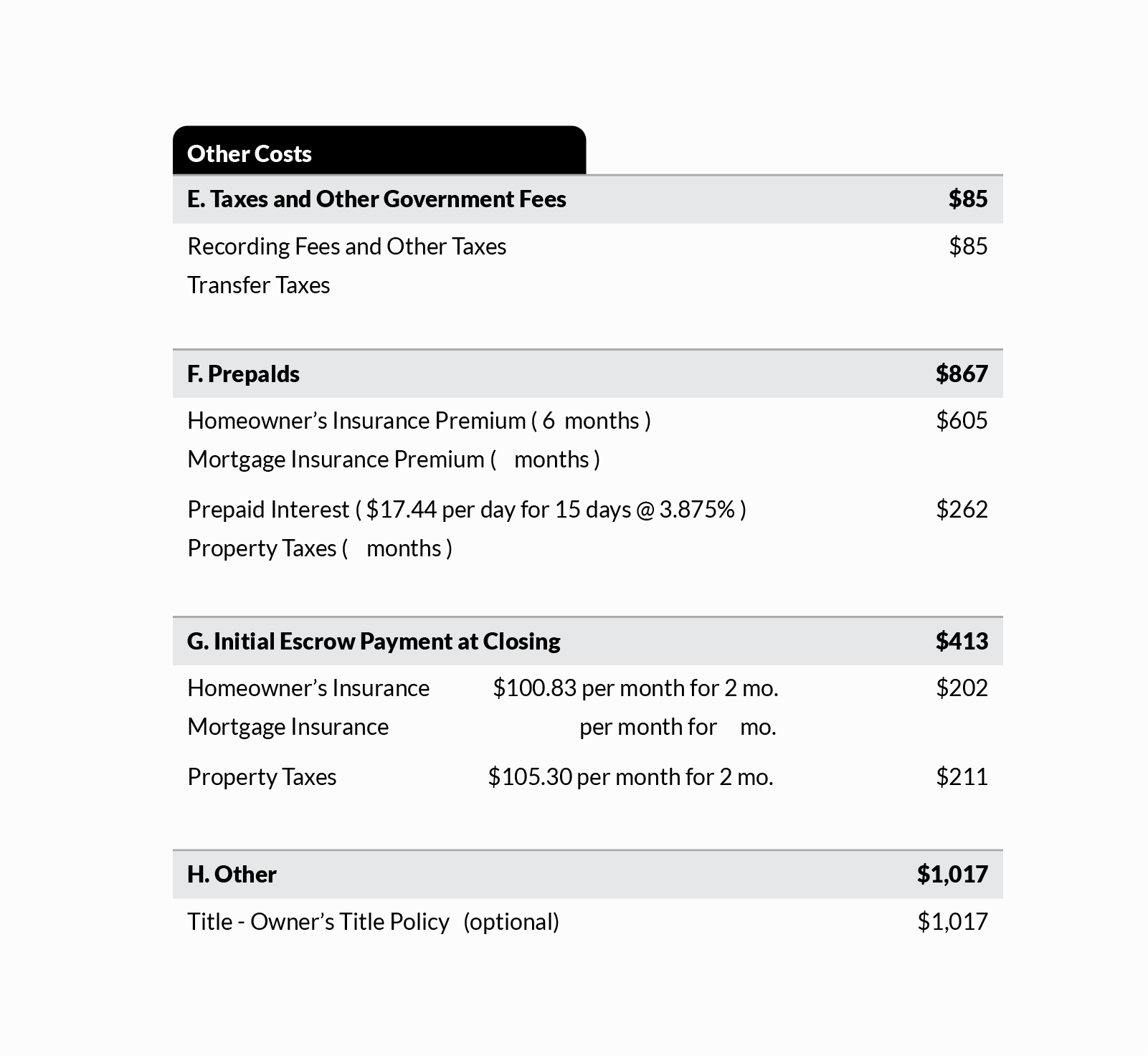

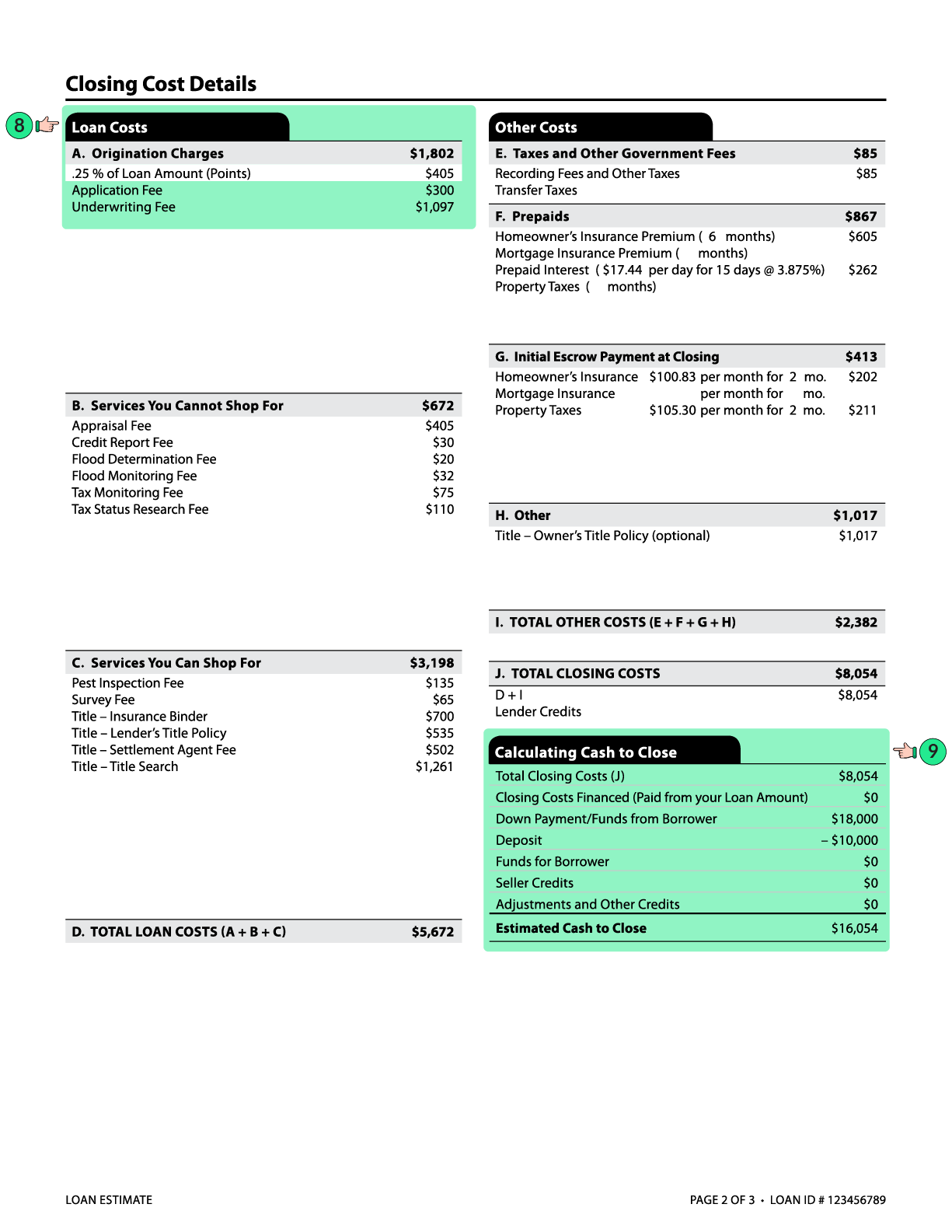

What Is A Loan Estimate How To Read And What To Look For

Bc Property Transfer Tax 2022 Calculator Rates Rebates

What Is A Loan Estimate How To Read And What To Look For

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Delaware First Time Home Buyer State Transfer Tax Exemption Prmi Delaware

What Is A Real Estate Transfer Tax The Civic Federation

![]()

Closing Costs Ontario You Must Know Before Buying Or Selling Property

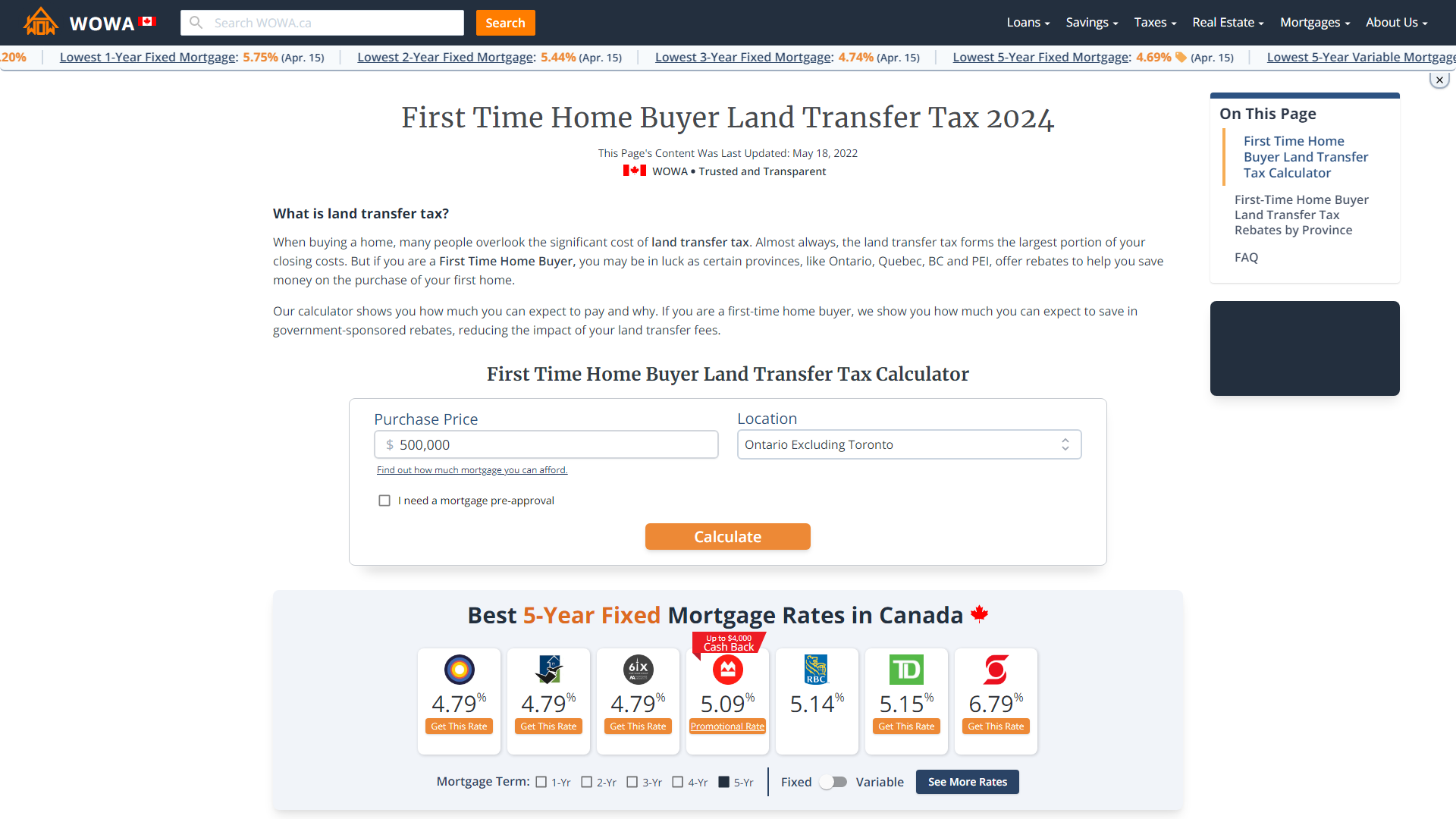

First Time Home Buyer Land Transfer Tax Rebate Criteria

What If My Co Purchaser And I Don T Both Qualify As First Time Homebuyers Ratehub Ca

Closing Costs That Are And Aren T Tax Deductible Lendingtree